The cautious forecasts advanced on occasion of the last edition of Pitti Uomo were indeed cautious. Italian men’s closed the year 2014 with a boisterous return to the positive side of the scale and a good growth rate of +3%, which boosted sector turnover to close to 8.8 billion euro. Foreign sales, up by +5.1%, contributed positively to Italian men’s fashion performance and although the domestic market remained in the negative numbers we saw a significant deceleration, to -3.6%, in the rate of fall after the serious setbacks of the 2011-2013 two-year period.

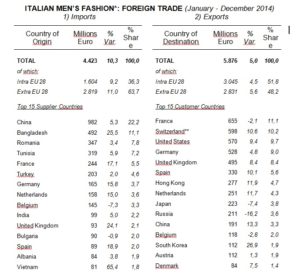

As expected, exports continued to represent the principal force driving expansion in the Italian men’s fashion industry. Thanks to a +5.1% growth rate, the value of sector exports topped 5.5 billion euro – for a gain of 1.2 percentage points in twelve months and a record 63.3% incidence of exports on total sales. And after two years of decreases, imports jumped upwards by +10.3%. Thanks to these foreign exchange dynamics, the 2014 Italian men’s fashion trade balance showed a slight drop but nevertheless remained above the 1.8 billion mark. According to ISTAT data, differently from in the preceding two-year period, in 2014 men’s fashion saw a realignment between import and export trends, with both increasing. Exports grew by +5% and imports racked up a two-digit increase of +10.3%. In terms of product lines, foreign sales increased for all the goods categories considered – exception made for ties (-4%). Exports of outerwear and of knitwear recorded evolutions of +4.7% and +5.4%, respectively.

“Over-achievers” with respect to the sector average were shirts (+7.3%) and leather apparel (+8.9%). A look at Italy’s foreign markets shows that both the EU and the extra-EU areas were favorable to the fashion industry, with growth rates of +4.5% and +5.6%, respectively. The EU market confirmed its standing as Italy’s largest consumer area, accounting for a 51.8% share of all men’s fashion exports. For Italian men’s fashion, 2015 opened with a continuance of the favorable trend experienced last year. According to ISTAT data, exports in the first quarter of the year increased by +3.8% with respect to the same period of 2014, while growths in imports remained in the double digits (+13.1%). In the case of exports, fabric outerwear, knitwear, and shirts grew at above-average rates, with increases of +4%, +6%, and +5.7%, respectively. Among the major customer markets, while France was down by -8.7%, all the others showed increases of a certain consequence: Germany grew by +6.1%, the U.S. by +14.6%, the United Kingdom by +13.5%, and Spain by +9.9%.

During the first three months of 2015, men’s fashion sales returned well into the positive figures in Japan (+5.6%), although the gain in Hong Kong did not top +1.8%. But China slipped by -3.7% and sales in Russia took a header, slumping by -22.9%.