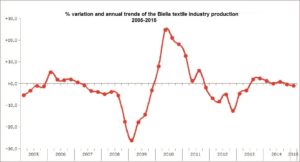

After a recovery that started in 2013 and a lasted for a large part of 2014, in the last three months of last year and the first three months of 2015 the Biella industrial production suffered a small setback. In the last quarter of 2014, in fact, manufacturing output fell by 0.4% over the same period the year before; in the first three months of 2015, the decline was of 1%. This is part of the data contained in the periodic survey released in May by the Biella Chamber of Commerce about the local textile district.

«The 1% production slowdown is accompanied by a decline in orders from Italy and abroad – Andrea Fortolan, President of the Biella Chamber of Commerce, says – even if the turnover achieved by local companies thanks to their export is still consistent. Except for spinning, all the other textile sectors are recording positive numbers, so we can say that there are signs of recovery, although not yet stable. That’s why we must continue to support our businesses, especially in the internationalization process, helping them to enter new markets and to deal with those already established».

Ups and Downs

The decrease in the Biella industrial production is the result of the negative performance of the sectors of spinning (-8.2%) and other manufacturing industries (-0.6%). Positive results have, however, materialized from weaving (+ 6.6%), finishing (+ 2.7%), other textile industries (+ 0.7%) and mechanical engineering (+ 0.4% ). Orders from the domestic market and from abroad were both down (-1.9% and  -1.3%) whereas foreign sales are increasing (+ 3.1%).

-1.3%) whereas foreign sales are increasing (+ 3.1%).

On the territory there are about a thousand companies active in the production of semi-finished products, yarns and fabrics, and the manufacture of clothing, which account for 42% of the Biella manufacturing sector and 5% of the total registered companies, which employ about 12,000 people.

At the end of 2014 the export of textiles and clothing from Biella has a value of over € 1 billion and 230 million. Looking at the interchange of the textile and clothing products, which accounts for about 78% of exports from Biella, the trade balance was positive by € 659 million. Among the main markets of the Biella textile and clothing products appear the most important EU countries (Germany, France, United Kingdom, Poland, Austria, Spain, Netherlands, Romania, Portugal), Switzerland, Hong Kong, China, Japan, Turkey and USA.

Upon disclosure of the economic data, the Unione Industriale Biellese (the local industrialists association) also announced the entrepreneurs prospect in the second quarter of 2015, recording an atmosphere of cautious optimism. The production forecast improves (the balance optimists-pessimists stands at 21.0%, compared to 5.3% in the previous quarter), just like total orders (16.4%, compared to 4.3% in the previous quarter) and foreign orders (32.7%, in the first quarter 2015 was just 5.8%).

However forecasts on profitability remain negative (-3.3%, in the first quarter of 2015 was -5.3%). The perception of moderate improvement is also reflected in the employment forecasts, because the optimistic-pessimistic balance about employment increased from 1.1% to 9.8% for the manufacturing sector and the planned use of income assistance is reduced to 22.2% from 26.6% of the last quarter.

Go Where Luxury Products Go

Emanuele Scribanti, vice President of the Unione Industriale Biellese, adds: «The cautiously optimistic sentiment of entrepreneurs for the second quarter of 2015 is the result of encouraging expectations linked to the economic performance both nationally and internationally. Compared to the first months of the year, in fact, today the outlook is more optimistic as regards the local industrial production, thanks to good forecasts in export orders, while expectations on profitability remain negative». This view is also mirrored on the employment front, which remains stable. It should be highlighted that this trend varies according to the different sectors: spinning, in particular, suffers from a situation of uncertainty. Foreign markets continue to be of central importance in the business strategy of the companies of the Biella cluster, which aims at the global niches of the high end markets. Another encouraging sign in this regard has emerged from the research “Export the Dolce Vita” of Confindustria and notes the further expansion of exports of luxury products in the top 30 emerging countries that, over the next five years, will grow by 45% reaching 16 billion euro.

Worldwide, the survey underlines, the number of wealthy people is to increase, reaching the amount of 202 million in 2019 compared to 2013; this refers to people with an annual income equal to 30 thousand dollars (purchasing power parity in 2010). Half of them reside in China, India and Brazil, but the affluent class is widening even in countries closer to Italy, such as Russia (with an expected increase of 5 million units in 2019). In these economies, the Italian production represents a status symbol for consumers, thanks to the strength of the big names, but also to the more general appeal of the “made in Italy” brand.

So there are good reasons to be optimistic, however businesses will have to work not only in terms of processes and product innovation, but also in terms of logistics, service, customization and branding. The next data will be disseminated in July and will be an important test to see if the Biella industry has finally embarked on the road to recovery or not.

by Debora Ferrero