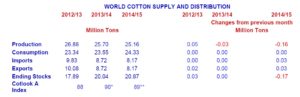

Since the beginning of April when the Chinese government announced a lower starting auction price, the pace of sales from China’s reserve increased and the Type 328 China Cotton Index (a daily index of prices for domestic cotton offered to mills in China) fell from 144 cents/lb. (9 months ave.) to about 129 cents/ lb. by the end of April. Although lower cotton prices are welcomed by the mills in China, a lot of damage has been done to the industry in the past few years by the Chinese government’s cotton policy. Since the start of its reserve policy in 2011, mill consumption has declined by 17%. In 2014/15, the decline in China is expected to slow, falling by just 1%. In 2014/15 India, Pakistan, and Turkey, the next three largest consumers, are all expected to see growth in their mill use while world consumption is expected to reach 24.3 million tons (+3%). On the other hand, world production is forecasted to decline by 2% to 25.2 million tons, narrowing the gap between production and consumption. India is expected to decline by 2% as the monsoon weather will not be as favorable as in this past season. However, most of the decline in world production will occur in China, where production is expected to decline by 10%, as the Chinese government has restricted its support for cotton to just the Xinjiang region, area outside is expected to fall significantly.

World trade is expected to decline to 8.2 million tons from 8.7 million (forecast for 2013/14). Again, this decline stems mostly from China, where imports in 2014/15 are expected to go down by 30% from 2013/14 and 60% from its peak in 2011/12. However, this decline will be partially offset by imports from Bangladesh, Indonesia, and Vietnam, which are expected to import a total of 2.4 million tons in 2014/15 (+13%).